Building Blocks for Involving Private Sector in Infrastructure

We take a look at the various procurement methods for infrastructure projects and discuss the key factors that regional governments consider when partnering the private sector.

Infrastructure, an essential building block for a country’s economic and social growth, is typically funded through taxes, user charges and/or government borrowings. The capital intensive nature of these projects has, however, increased fiscal strains, prompting regional governments to consider alternative funding models to fulfil their infrastructure requirements.

The Global Infrastructure Hub (GIH) estimates that Asia’s total infrastructure investment needs will cumulate to US$51 trillion in the next 20 years, with energy and road infrastructure contributing to the largest needs of US$34 trillion by 2040.

Partnering the private sector to finance projects and capturing the economic value of infrastructure through approaches such as asset recycling and land value creation, particularly for projects with clear, long-term revenue streams.

Michael Tan, Managing Director & Partner, BCG shared that “timely infrastructure investments can play a critical role to boost the economic capacity for a country, accelerating growth and productivity. Innovative partnership arrangements between the public and private sector can be very helpful for catalysing these investments and should be proactively pursued.”

Indonesia West Java Metro Bandung

The West Java Province (Bappeda Jabar) is planning a 16.55km Light Rail Transit (LRT) line passing through Tegalluar under a Public Private Partnership (PPP) financed by the federal state through PT Sarana Multi Infrastruktur (Persero). Apart from the construction of the LRT, the project will also incorporate transit-oriented elements to maximise the economic value of the surrounding real estate development to increase public ridership, farebox and non-farebox revenues.

In principle, PPP allows the public sector to obtain better value for money in the delivery of the public services. As highlighted in an article on “Public-Private Partnership (PPP)” authored by Ng Kai Scene (Director, Infrastructure Asia), there is no standard definition of a PPP model, and there can be a spectrum of procurement models used by the Government to procure infrastructure, as illustrated below.

Spectrum of procurement models used by governments for infrastructure

Source: https://www.infrastructureasia.org/en/insights/public-private-partnerships

A Twist to PPP – The Swiss Challenge Approach

Infrastructure projects under PPP are typically planned and designed by the Government; this limits the extent of innovation and new offerings from the private sector. However, the “Swiss Challenge” model allows companies to ideate projects which they feel are commercially viable, and to submit an unsolicited proposal to the Government for approval.

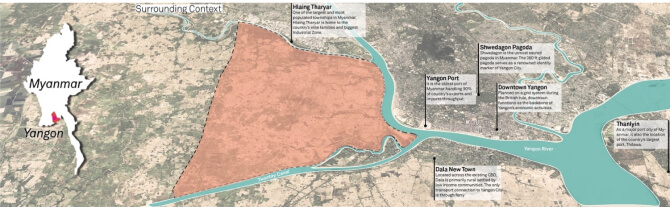

New Yangon City Project

The New Yangon City, a 90-sqkm development to the west of central Yangon, has adopted this model (called the “NYDC Challenge”) for its Phase 1 infrastructure projects. Under the Phase 1 Stage 2 infrastructure project1, the New Yangon Development Company (NYDC) received more than 40 Expressions of Interest (EOI) from international companies keen to participate in its development.

Established in 2018, NYDC is an entity owned by the Yangon Regional Government (YRG), and has been tasked with the development of the New Yangon City. Under the NYDC Challenge, one company (the “Preferred EOI Applicant”) will be selected through an evaluation process to undertake preliminary work and feasibility studies to prepare the Pre-Project Document (PPD) at its own expense. Recognising the importance of selecting companies with the right resources and expertise, IA supported NYDC to develop a holistic set of evaluation process and criteria; these guide the project scope and addresses the concerns of the EOI applicants. Such capability building support for the Government gave international investors more confidence in the robustness of the NYDC Challenge, given that this is largely a new form of project in Yangon.

Upon identification of the Preferred EOI Applicant, NYDC will start a negotiation process until a mutually acceptable deal is reached. A provisional agreement will then be entered into between the Preferred EOI Applicant and NYDC. The entire contents of the PPD and provisional agreement will be published to allow any qualified party to challenge through better terms within a designated period, without compromising on the terms and conditions of the agreement. Should a third-party accept the challenge with better offers, the Preferred EOI Applicant retains the right of first refusal to counter-match the new offer. In the event that the third-party wins (the “Selected Bidder”), all expenditure incurred in relation to the preparation of the PPD will be paid by the Selected Bidder to the Preferred EOI Applicant.

Under this approach, New Yangon City Phase 1 Stage 2 projects attracted quality bidders with good track records who submitted well-measured concept plan for the New Yangon City. Negotiations with Thailand’s PTT Group comprising PTT/ PTT Exploration and Production (PTTEP)/ Global Power Synergy (GPSC) and India’s IGL consortium comprising Indraprastha Gas Limited and Gail are already underway for the “power supply & distribution” as well as the “natural gas supply & distribution” packages respectively.

Government Funded or PPP?

With proper processes, the Swiss Challenge model ensures efficiency and allows for fair competition and transparency. It also promotes the origination of ideas from private investors, who could have a better assessment of the bankability of the projects. There is also certainty that at least one willing partner would invest in the project. Jennifer Tay, Partner, Capital Projects & Infrastructure, PwC Singapore, highlighted that “the Swiss Challenge Process helps alleviate resource and capacity constraints in the initial feasibility study of the project, which we commonly see within government agencies in developing nations. At the same time, the process brings in private sector innovation (in design, construction, operation/maintenance and financing) from the start.”

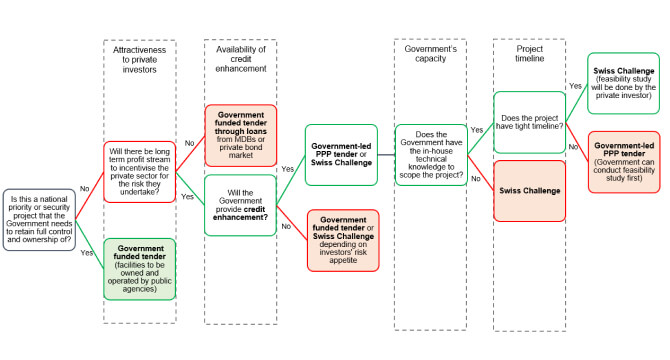

Typically, there are four key factors when regional governments consider the procurement approach for public infrastructure – i) attractiveness to private investors; ii) availability of credit enhancement, iii) government’s technical and financial capacity and iv) timeline of project. Diagram 2 shows a decision tree reflecting the various procurement methods for infrastructure projects, assuming that a) the private sector can optimally crowd in the efficiencies required for the execution of these projects, and b) the Government has already obtained consensus to implement the project.

Infrastructure Procurement Approaches

As illustrated in the decision tree, even if a project is attractive to the private sector, the Government may choose to adopt the Swiss Challenge procurement option if there are capacity or timing issues.

In addition, there is no fixed sequence for which the decision factors should be considered. There could also be a combination of procurement approaches across different stages of the project lifecycle (e.g. civil construction funded by the Government, while operations & maintenance are funded through private investments). However, proper pre-feasibility or a good set of selection criteria helps frame the project needs and make the project(s) attractive to quality international players, as reflected in Phase 1 Stage 2 of the New Yangon City project.

Phnom Penh Waste-to-Energy (WTE) Facility

Phnom Penh’s only landfill in the Dangkor district is approaching its limit and is expected to be filled up in the next two to three years. Consequently, the Ministry of Environment (MOE) is considering developing a WTE facility to treat the solid waste. As a first step in determining the viability of the WTE project, MOE has commissioned a pre-feasibility study, which will provide analyses on the technology, costs, schedule and financials.

Conclusion – Risk Mitigation A Key to Successful PPP

With multiple options for infrastructure financing depending on the projects’ fundamental conditions, the key to a successful PPP still lies in proper risk mitigation strategies. Michael Tan, Managing Director & Partner, BCG, agrees, sharing that “historically, major infrastructure projects have experienced a range of common problems such as delays, cost overruns and lack of financing. Having a clear risk management approach and alignment of interests upfront can help to avoid many of the downstream problems”.

The importance of early engagement of a trusted risk advisor (i.e. one who fully understands PPP structures, the complexities of their project documentation and the interlinkage with project financing) and the role that such an advisor plays, should not be underestimated.

Diligent risk and insurance management is an essential contributor in achieving successful and cost-effective project outcomes. In our experience, project owners who can demonstrate solid risk management strategies have a better chance of achieving greater project bankability, earlier financial close and at times more favourable financing terms than otherwise. This is because financial institutions place significant emphasis on the project owner’s approach to risk management. They prefer to see a systematic process and proactive technique that delivers a robust framework and reassurance that project risk has been appropriately considered and mitigated. For instance, being able to compare the various risk mitigation methodologies and their respective costs, allows a project owner to make better risk management decisions (and brings risk management into line with investment decision-making techniques).

Nicki Tilney, Head of Construction, Power & Infrastructure Asia, Aon Commercial Risk Solutions, indicated that “a strong advisory team can play an important part in the project team by delivering a comprehensive “risk matrix” to demonstrate how various risk exposures could be actively, robustly and cost-effectively managed. Understanding the technical and commercial issues that affect project development and appreciating the interaction and exposures generated by all facets of the project can help project owners navigate risk throughout the projects’ lifecycle.”

Myingyan Power Plant

Risk diversification could also be achieved through a strong consortium of partners. Sembcorp Myingyan2 in Mandalay, Myanmar had the support of multilateral institutions including Asian Development Bank, Asian Infrastructure Investment Bank and International Finance Corporation to develop a financing structure that successfully drew in the right global commercial lenders including Clifford Capital, DBS Bank, DZ Bank and OCBC Bank.

Mumbai Metro Project

In 2007, Line 1 of the Mumbai Metro between Ghatkopar and Varsova was awarded to a Reliance Infrastructure-led as the first PPP metro project. During the construction phase, the project met with some bottlenecks including cost escalations, land issues and delays in construction. The Mumbai Metropolitan Region Development Authority (MMRDA) is reviewing the possibility of adopting the PPP approach for the upcoming Kanjurmarg-Badlapur line, drawing experiences learnt from the past PPP arrangements. Infrastructure Asia can support regional projects in early project scoping, best practice sharing, deal brokering, and harnessing Singapore’s best-in-class infrastructure ecosystem. Through our efforts, we hope that more regional projects can be well scoped to match the optimal PPP model, thereby improving infrastructure financing and development through innovative structures that are well-adapted to the regional needs.

1 Phase 1 Stage 2 infrastructure projects include the development of power supply and distribution, public transport system, cyber connectivity infrastructure, municipal waste disposal, natural gas supply and distribution, convention center. Upon appointment, the companies (one per project) will embark on feasibility studies for the projects 2 A 225-megawatt gas-fired Independent Power Plant (IPP)

This article was collated by Seth Tan and Goh Guan Hui, and benefitted from the sharing of the following contributors:

- Nicki Tilney, Head of Construction, Power & Infrastructure Asia, Aon Commercial Risk Solutions

- Michael Tan, Managing Director and Partner, Singapore, Boston Consulting Group Singapore

- Jennifer Tay, Partner, Capital Projects & Infrastructure, PwC Singapore