Water and Sanitation in Asia

Water is essential for human life and UN recognises that access to safe drinking water and sanitation is a basic human right yet, meeting water needs has its challenges. We explore how innovation in water technology and financing can help improve the bankability of such projects in order to crowd in private capital.

The Need

Water is essential for human life. People need water for drinking and household activities, and industries require water in their production processes. Water is also the foundation of agriculture - which essentially feeds the world. The UN recognises that access to safe drinking water and sanitation is a basic human right1 and have labelled it as one of its Sustainable Development Goals (SDGs).

However, in Asia today, 300 million people do not have access to water, and 1.5 billion lack basic sanitation2. It is no surprise that many governments have prioritised improving their water supplies and safely managing used water so that it does not compound existing hygiene and environmental problems. Yet, meeting water needs has its challenges – climate change calls for infrastructure to be more resilient; governments are compelled to keep water tariffs as low as possible to maintain affordability; and the lack of public funds hinders water and sanitation projects, which tend to be capital intensive.

In this article, we explore how innovation in water technology and financing can help improve the bankability of such projects in order to crowd in private capital.

Investing in Technology

Technology developments in water continue to be driven by the push to achieve more advantages over existing systems. These include reducing capital and operating costs, improving efficiency and service levels, and achieving better treated water quality. In turn, such positive outcomes could translate into more commercially viable projects.

Reducing Costs of Water Treatment

With the increasing occurrence of extreme weather events, more countries - including those in Southeast Asia - are looking towards more water sources to improve water security. Desalination, known to be a traditionally energy-intensive process, has now become a key component of water supply in several countries. It is usually more costly than producing drinking water from freshwater sources, ground water or even water recycling, and rarely taken up by developing countries. However, desalination technology is becoming more efficient. Today, reverse osmosis is the most commonly used process for desalination, and its uptake has increased over the past years compared to distillation, due to the decreasing costs of producing membranes. Continuous effort is being made to drive production costs down. Since 2018, Singapore’s National Water Agency, PUB, and Evoqua Water Technologies trialled the use of Electro-deionisation (EDI) technology in a 3,800 m3/day demonstration plant in Singapore. This uses a low-pressure process that utilises an electric field to remove salt ions from seawater. If proven successful on a large scale, this would be a significant breakthrough, reducing energy consumption by half, from 3.5 kwh/m3 to 1.65 kWh/m33.

Another strategy to manage energy consumption of water installations is the co-location of facilities, said William Yong, Managing Director, Southeast Asia, Water for engineering firm Black & Veatch. One example is Singapore’s Jurong Island Desalination Plant (JIDP). JIDP, Singapore’s fifth desalination plant, will be co-located with Tuas Power’s existing Tembusu Multi-Utilities Complex to derive synergies in resources such as seawater intake and outfall structures, and energy from the in-plant generation facilities. Lower energy consumption will further drive treatment costs down, thereby making the supply of water through desalination more viable. To mitigate project risks, partnering the right consultants with global best practices and regional execution experience is critical.

Co-location of facilities in JIDP (Source: Black & Veatch)

Reducing Losses due to Non-Revenue Water

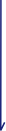

Further to augmenting water supply, technology could be used to reduce losses from non-revenue water (NRW). Physical and apparent water losses form significant revenue losses for utilities, and the former also adds further costs from the production of water to compensate for the leakage. According to Liemberger and Wyatt (2018), Asia loses US$14.2 billion each year from NRW4.

Non-revenue water in selected economies of Asia5

This has driven the development of smart water solutions. Water technology company, Xylem, emphasises using smart water technologies to conserve water and save time on condition assessments. Its subsidiary, Visenti, installed over 300 sensors in Singapore’s potable water supply pipelines to detect water leaks. Through employing advanced analytics, operators were able to detect leaks and bursts in real time, predict demand, and simulate operations. This contributed to reducing Singapore’s NRW to 5%6.

Another example where technology was leveraged to reduce NRW was Lisbon-based water company EPAL’s use of a leakage-monitoring computer programme. This enabled them to identify potential leaks by comparing live water usage information with predicted demand levels. Over the course of 10 years until 2015, water losses were reduced by over 20%, resulting in accumulated savings of €68 million. In contrast, the city only invested about €7 million into the project7. In many cases, investing in NRW reduction offers not only strong returns, but also allows utilities to improve end-customer service and operating efficiencies.

While such novel solutions allow enhancing network management, other initiatives such as Performance Based Contracting (PBCs) have also been explored to address high levels of leakage. A report by the Public Private Infrastructure Advisory Facility and the World Bank Group describes how utilities could engage specialised private-sector contractors through PBCs. There are several forms of PBCs - concessions, rehabilitate-operate and transfer, or hybrid operating/lease contracts – each of which sees the performance risks of the utility transferred to the private sector partner8. By structuring the PBC to incorporate a payment according to performance, the private sector would be incentivised to deliver the product against the performance specifications in the contract. This solves a common issue of utilities not having relevant know-how and funds to carry out NRW management activities such as network rehabilitation, establishing monitoring regimes, and implementing proper accounting systems.

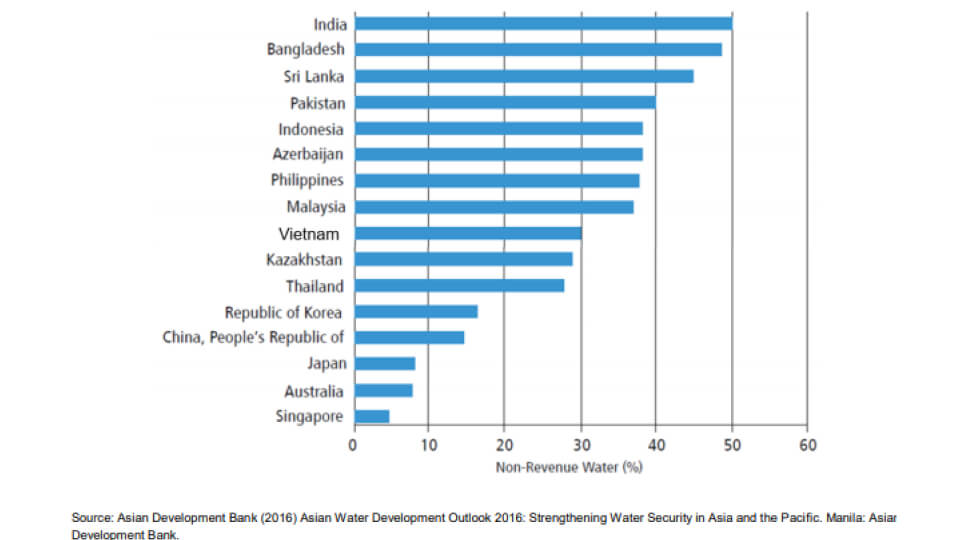

Reducing Distribution Costs through Decentralised Solutions

An emerging paradigm shift in reducing water produced that is lost before reaching customers is to bring the production centres closer to the customers. Conventional systems that involve high capital costs and cost recovery are becoming even more difficult to implement for smaller populations over large areas. Decentralised water systems, which are low-cost and adaptable, offer an alternative solution to rural areas or scattered settlements where centralised systems are not economically viable. The technology comes in modular form and can often be a plug and play solution to local communities9. Given its modular nature, the systems can be easily expanded as the population grows and can subsequently evolve into centralised systems. This extends to wastewater as well. Where wastewater facilities are located close to the wastewater source, the investment costs of a sewage network can be reduced.

Examples of decentralised solutions by Suez and ECOSOFTT

Mitigating Technology Adoption Risks

Despite the benefits of adopting newer technologies, the uptake of novel water solutions is notoriously poor. The water industry is known to be a conservative one, with utilities often going for proven technology. This is unsurprising as water is a basic necessity and the continuous provision of water is often the responsibility of governments. If stringent requirements and regulations are not in place, utilities may also be disinclined to invest in the latest technology. Leveraging private sector investment, however, supports the adoption of sophisticated technology because companies would operate at competitive levels to sustain their own business generate profit, e.g. through efficiency gains10. Depending on the PPP arrangement, the end of a concession agreement often allows the public sector to receive these facilities that have incorporated the technology.

There are increasing concerns in the market that disruptive technology and changes in environmental law compel utilities to make adjustments to their already-built facilities. These could include performing technological upgrades or replacing obsolete equipment. However, such risks can be mitigated by building contractual variations mechanisms or other specific contractual obligations in the PPP agreement, as highlighted in the PPP Risk Allocation Tool 2019 Edition developed by the Global Infrastructure Hub (GI Hub) and Allen & Overy11. For example, the private partner’s obligation is to meet output specifications and need to replace technological solutions to do so. On the upside, agreeing on cost sharing arrangements can also allow utilities or contracting agencies to request technological upgrades, e.g. if the new solution brings with it added environmental and social benefits.

As with almost all PPPs, clear legislations and well-crafted risk allocation frameworks can enable the incorporation of technology in water projects. To encourage better-structured PPP projects in the region, Infrastructure Asia (InfraAsia), together with the World Bank Group, will be conducting a capacity building programme, “Growing Infrastructure – Enabling & Structuring for Private Sector Participation in Finance and Innovation’. Specially curated for government officials, this programme seeks to improve the understanding of how PPPs are delivered, how international finance can be enabled in various infrastructure sectors, and the innovative technologies applicable in infrastructure.

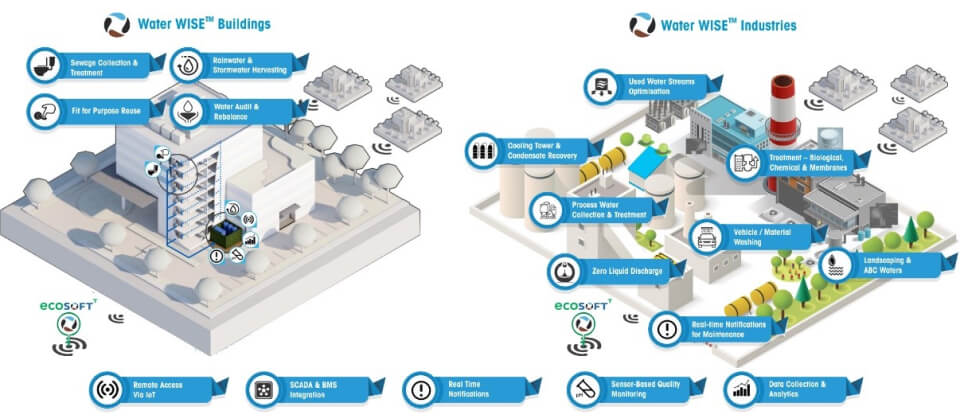

Crowding in Private Capital and New Forms of Financing

There are several financing challenges commonly faced when securing capital to develop water projects. One of such challenges in emerging Asia is the nature of offtakers, according to Eileen Yan, Executive Director of Deloitte Singapore. In many existing contracting models in the region, utilities are private companies, and investors may find it difficult to accept the commercial and credit risks of such privately-owned offtakers. On the other hand, greater investor confidence is built when the government is the offtaker. One example is TTW Public Company Limited 30-year concession agreement with the Provincial Waterworks Authority of Thailand to operate water production and distribution under the Build-Own-Operate mode.

Thailand water supply PPP structure

Another deterrent water service providers face in raising debt from commercial banks is the inability to generate sufficient revenue from end users through tariff collection. In such cases, other sources of financing may need to be sought. Development Finance Institutions like multilateral development banks provide tools to mitigate these revenue risks in several ways. These include financial guarantees, escrow accounts, hedging mechanisms, and insurance. AIIB states that multilateral development banks can leverage their funds to help countries overcome financing challenges and attract commercial finance. Blended finance allows more affordable borrowing rates and can accommodate political constraints that set a ceiling on tariff levels. It also reduces lender risk through the participation and due diligence of the MDB12. The World Bank Group provides an example of how blended finance supported water projects.

Public-Private Partnership (PPP) has worked well in Metro Manila, with its two private concessionaires (Manila Water and Maynilad Water) delivering good results in water supply services. Recently, the concessionaires have shifted their attention to meeting the sanitation needs of the metropolis to improve environmental conditions and have embarked on an ambitious investment programme to clean-up Manila Bay. The Government supported the concessionaires in accessing funds from MDBs, including the World Bank and JICA, for the Metro Manila Wastewater Management Project. With this concessional funding, as well as their own funds, the concessionaires were able to develop wastewater conveyance and treatment infrastructure. Thus far, signs of cumulative reductions of Biological Oxygen Demand (BOD) in the collected wastewater for treatment have been positive, and the population benefitting from it continues to increase.

Climate/Green Bonds and Impact Investors

With growing climate issues, water and sanitation infrastructure are increasingly being scaled up to support climate adaptation. These activities range from building new infrastructure, replacing existing facilities, or upgrading them. Singapore plans to spend $100 billion on coastal protection measures to mitigate rising sea levels caused by climate change. Such drives to improve climate resilience, although costly, open avenues beyond traditional equity and debt, such as climate or green bonds. The Business Times reported in April 2020 that the volume of green bonds and loans in ASEAN almost doubled from US$4.1 billion in 2018 to US$7.8 billion in 2019, and Singapore contributed to 55 percent of the ASEAN green debt issuance in 2019. Singapore’s green bond market today stands at more than US$4.5 billion and will continue to enable more green bonds. An article collated by InfraAsia also further describes the increasing focus of green finance in the region.

Family offices can become more relevant in sustainability and water infrastructure. Typically armed with a mandate to make investments that benefit society and the environment, these impact investors provide another source of funding. Decentralised solutions have project sizes smaller than that of traditional centralised treatment facilities, which fit into the appetite of family offices. The demand for water has also driven the formation of many start-ups that focus on developing innovative solutions. Family offices are a common supply of venture capital - their funds usually deployed for decades, making them far less vulnerable to panics than banks and hedge funds13.

Infrastructure that can Hold Water

Water continues to be the foundation of population and economic growth, and managing the water cycle - from clean water supply to safe release of treated used water - is not an easy task. Climate change has added further complexities and emphasised the need to develop sustainable and resilient water infrastructure. With a conducive ecosystem of public agencies, consultants, architects, developers, third-party certification firms, researchers, and financiers, Singapore - through InfraAsia - can be a focal point to contribute to water infrastructure development in Asia and beyond.

1 https://en.unesco.org/themes/water-security/wwap/wwdr/2019

2 https://www.adb.org/sites/default/files/publication/227496/special-report-infrastructure.pdf

3 https://www.straitstimes.com/singapore/pub-seeks-to-cut-energy-needed-for-desalination

4 http://www.waterloss2018.com/wp-content/uploads/2018/06/08/A24.pdf

5 Asian Development Bank (2016) Asian Water Development Outlook 2016: Strengthening Water Security in Asia and the Pacific. Manila: Asian Development Bank.

6 https://www.xylem.com/en-sg/making-waves/water-utilities-news/smart-water-leak-detection-and-non-revenue-water/

7 https://www.ingwb.com/media/2607443/seizing-the-water-opportunity-report.pdf

8 https://ppiaf.org/documents/3531/download

9 https://www.thehindubusinessline.com/opinion/decentralised-tech-can-help-meet-water-demand-during-covid/article31565480.ece

10 http://www.iwmi.cgiar.org/Publications/Books/PDF/resource_recovery_from_waste-656-669.pdf

11 https://cdn.gihub.org/umbraco/media/2667/gih-ppp-risk-allocation-water-and-waste.pdf

12 https://www.aiib.org/en/policies-strategies/operational-policies/public-consultation-draft-water-sector-strategy/.content/_download/AIIB-water-sector-analysis.pdf

13 https://www.economist.com/leaders/2018/12/15/how-the-0001-invest

This article was collated by Jeremy Kum and Seth Tan and benefitted from the information and views shared by:

- William Yong, Managing Director, Southeast Asia, Water, Black & Veatch.

- Mr Christopher C. Ancheta, Senior Sanitary Engineer, World Bank

- Ms Irma Magdalena Setiono, Senior Water and Sanitation Specialist, World Bank

- Mr James Tay, Country Officer, World Bank

- Eileen Yan, Executive Director, Deloitte Infrastructure & Capital Project Advisory, Southeast Asia