Standardising 50% of Project Finance Loan Documentation

Project finance loan documentation are notoriously long and complex. In this article, Infrastructure Asia explores how standardisation can help to ensure quality and replicability, and shares its effort in this area.

In the 1990s, the market considered project finance as one of the more rigorous types of bank financings. If any project fails, lenders (particularly those who lent on a non-recourse basis) will not get their loans repaid. Hence, project finance loan documentation must be detailed and comprehensive enough to address various risks and scenarios that a project could face. Consequently, in many cases, when one prints out the project finance loan documentation, it could stack up to almost half a person’s height.

Fast forward to 2020, the situation in Asia has changed.

- Increased experience of project owners: As more Asian projects get financed, built and operated over the years, there is increasing awareness of key issues facing infrastructure projects, including the effects of various financial crises.

- Changing preferences of financiers: On the supply-side, more banks are now keener to lend shorter tenors due to a combination of regulatory capital considerations and individual banks’ preference. Thus, the ability to refinance is getting more important. In other markets, there is also increasing interest from sophisticated institutional investors who are gaining interest in investing in project bonds or infrastructure debt.

- Non-recourse becoming less popular: Non-recourse finance is a type of lending that entitles the lender to repayment from the cashflow of the project, and not from other sources. While it is certainly more beneficial to the borrower, it is not always possible in Asia, hence various credit enhancements and additional non-project collateral help to enable financings. As a result, different degrees of standard project financing are being employed. For many projects, the mode of financing infrastructure is changing from “project financing” to “financing projects”.

Despite these changes, it generally still takes a long time - sometimes years - to complete project finance loan documentation for cases in emerging Asia. As each set of documentation is largely bespoke, this not only adds to the cost to close, but also makes infrastructure debt less “tradeable”.

As the infrastructure financing gap in Asia remains large, various approaches may be needed to help fund the infrastructure needs in Asia. Some say capacity building of regional demand-side counterparts is important to raise their awareness on what can be contributed to enable more bankable infrastructure cases. Others say early stage preparation is important to ensure the building blocks of bankability are put in place to better attract financiers’ interest. Yet others say optimisation of project financing as an approach could also help.

Learning from the larger project finance markets to optimise project financing

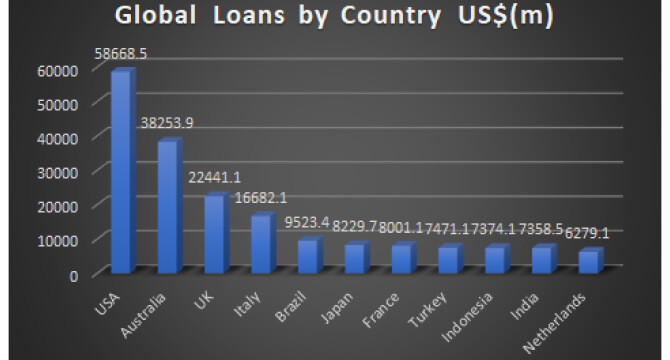

Based on PFIe data, the United States of America (US$58.7 billion), Australia (US$32.8 billion) and the United Kingdom (US$22.4 billion) have traditionally been topping the league tables in terms of project finance transaction volumes (see graph below).1 In 2018, these three markets accounted for 40% of total global project finance transaction volumes. Hence there may be value in identifying features of such markets that can be replicated in or adjusted to fit an Asian setting. Two such features that Asia can draw are – increasing homogeneity from banks and streamlining origination.

Global Loans by Country US$(m)2

One key factor for the proliferation of project finance in these markets is homogeneity. The lack of homogeneity within the Asian market may prevent the Asian project finance market from rising to the level of these top three markets. However, with 60% of project finance loans in Southeast Asia originating from banks based out of Singapore, these financial institutions could initiate some level of homogeneity.

The institutional bond market can help to refinance banks, as banks may be more suited to finance the construction stage of projects. In a G20 white paper on sustainable infrastructure securitisation, private sector participants indicated the importance of having appropriate collateralisation and securitisation platforms. Such platforms help to establish a market for infrastructure securitisation in specific collateralised loan obligations (CLOs).3 The CLOs would allow for an efficient structure of liability and asset seniority to cater to investors of varying risk appetites. The findings suggest that the bond market alone would provide US$1-1.5 trillion annually of additional private capital for infrastructure projects. The study also found that by 2035, bonds for low carbon energy investments could scale up from US$4.6 trillion to US$5.6 trillion globally.

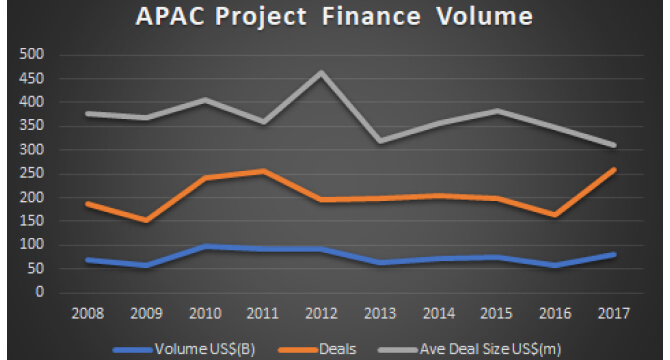

An increase in smaller value project finance deals in the three markets could also be a contributing factor for the proliferation of project finance. Within Asia, many large-scale projects have already been implemented in the earlier years, and project finance banks have now started to look at lower value deals. This trend can be seen below.

Volume and Deal Flows of Project Finance deals in APAC4

As such, streamlining the origination process will become important to reduce the resources allocated to closing each of these smaller but more frequent deals, and also ensure that efforts for subsequent deals are scalable.

Bridging the financing gap with standardisation

In recent years, there has been a huge shift towards standardisation, in both the real and financial economy. From industrial to financial reporting standards, standardisation ensures quality and replicability. It puts multiple stakeholders-to-be on a similar footing, minimises information asymmetry, and promotes transparency.5 In the financial world, standardisation also allows for greater comparability and easier risk assessment which are the key to efficiently pricing of assets.

There has been a push by the Organisation for Economic Co-operation and Development (OECD) to establish infrastructure assets as a new asset class through standardisation. The whole initiative was established with the aim of adopting a new collaborative approach to crowd in private capital and tap on the large pool of private savings for long term growth and development.6 To this end, three overarching pillars were used to organise the OECD roadmap to make infrastructure a new asset class. One of the pillars identified was promoting greater standardisation, which was then further split into two parts - contractual standardisation7 and financial standardisation8.

Financial standardisation refers to the process of creating standard funding contracts with clauses and enforcement that adopters can get familiar with. This leaves more time for contracting parties to negotiate clauses that are more proprietary. The prevalent adoption of such standardised clauses also allows for a deeper pool of similarly structured assets made available in the market, making pricing of such deals at dates before maturity less time intensive. The result is the simplification of refinancing or securitisation, and increased palatability of project finance assets to other sources of liquidity.

The sentiment for increased financial standardisation can also be observed in Asia. During a meeting between ASEAN finance ministers in 2018, Singapore’s then Finance Minister Heng Swee Keat called for greater standardisation in infrastructure finance documents. He also mentioned that appropriately drafted public-private partnership (PPP) contracts and clauses are critical to provide private investigators with greater transparency and confidence.9

Law practitioners also agree with these benefits. Kok Chee Wai, Partner of Allen and Gledhill, said “having standardised documentation allows parties to focus on areas which are specific or bespoke to the transaction in question.”

A project financing loan typically includes the common terms and facility documents, shareholder/ sponsor documents, security documents and account documents. The agreements will contain usual provisions relating to covenants and events of default, similar to other syndicated loan agreements (though this may expand to cover project related matters).10 Within this suite, it may be useful to create a partially standardised set of loan documents.

Nicholas Wong, Partner and Co-Head of the Worldwide Projects Group at Clifford Chance also said that “we have witnessed the transition of global capital towards Asian infrastructure projects, with this increasing focus, projects in Asia need to be more bankable and investible, and the underlying documentation must be drafted in a manner that facilitates widespread adoption by the market, a baseline which can be applied broadly to transactions across jurisdictions and asset types.”

If partially standardised project finance loan documentation contributes to a more homogenous market for project finance loans, it will increase the chance of refinancing and even the securitisation of these loans11, opening the doors of the infrastructure financing market to non-bank pockets of liquidity such as pension funds, mutual funds and family offices.

A success story closer to home

Closer to home, there have been novel ways of creating innovative platforms to help facilitate investors’ access to infrastructure debt.

One groundbreaking initiative is the US$458 million Bayfront Infrastructure Capital takeout facility established by Clifford Capital. The first of its kind in Asia, the facility enables institutional investors to provide liquidity to the takeout facility (Bayfront Infrastructure Capital) while being issued asset backed securities in return. Bayfront would then provide this liquidity to lending banks in return for the infrastructure loans, which enables relief of the banks’ capital reserve ratios by lowering the risk weighted assets on their balance sheet through the facility. The loans issued to the takeout facilities will then be repackaged into the asset backed securities, which are then tranched and given credit ratings by Moody’s based on each underlying loan.12. The first of its kind in Asia, the facility enables institutional investors to provide liquidity to the takeout facility (Bayfront Infrastructure Capital) while being issued asset backed securities in return. Bayfront would then provide this liquidity to lending banks in return for the infrastructure loans, which enables relief of the banks’ capital reserve ratios by lowering the risk weighted assets on their balance sheet through the facility. The loans issued to the takeout facilities will then be repackaged into the asset backed securities, which are then tranched and given credit ratings by Moody’s based on each underlying loan.12

The Bayfront platform illustrates how new pockets of liquidity from institutional investors can be brought in to help plug the ever-growing Asian gap in infrastructure financing. According to the Monetary Authority of Singapore (MAS), the platform is a good example of how infrastructure can be developed as a mainstream, investable asset class to help crowd in institutional capital.”13

The standardisation of project loan documents can increase the ease and efficiency of developing such takeout facilities to improve market liquidity.

Infrastructure Asia’s contribution to tipping the balance

During the Asia Infrastructure Forum 2019, Indranee Rajah, Singapore’s Minister in Prime Minister’s Office and Second Minister for Finance and Education, announced that Infrastructure Asia, an organisation set up by Enterprise Singapore and the Monetary Authority of Singapore, was working with law firms to standardise clauses in project finance loan documents – an effort to reduce time and cost and make processes more transparent. The remaining 50% of clauses would remain customisable according to individual project needs.

Minister Indranee said "this will contribute to a more vibrant secondary market in infrastructure debt and attract non-bank investors into this asset class."

Being a neutral organisation, Infrastructure Asia hopes to come up with a suite of documents that is “middle-of-the-road” in terms of risk allocation. Working with legal firms experienced in local and international project finance like Clifford Chance and Allen & Gledhill, the initial draft of documents is planned to be ready within 2020.

The next step would be to socialise the document with the key players in the market. With the changing market and supply side situation, the conditions are ripe for this 50% standardised project finance loan documentation to contribute to more project financing in Asia, thereby contributing to reduce the infrastructure financing gap in the region.

1 Thomson Reuters, 2019. PFI Financial League Tables 2018

2 PFI League Tables 2018

3 G20 Sustainable Finance Study Group, 2018. Towards A Sustainable Infrastructure Securitisation Market: The Role of Collateralised Loan Obligations (CLO)

4 PFI League Tables

5 Blind, K., Jungmittag, A. and Mangelsdorf, A., 2011. The economic benefits of standardization. DIN German Institute for Standardization.

6 Organisation for Economic Co-operation and Development, 2018, Roadmap To Infrastructure As An Asset Class

7 Contractual standardization refers to the standardization of contracts and documents that is associated with the project operation such as tender documents throughout all stages of the project lifecycle. Such standardization prevents over complicating the requirements and technical specs of the project which in turn helps increase consistency and transparency from the feasibility study all the way till the operations and management of the project.

8 Organisation for Economic Co-operation and Development, 2018, Roadmap to Infrastructure as an Asset Class

9 Business Times, 2018. Make ASEAN Infrastructure Financing an Asset Class: Heng Swee Keat

10 Dentons, 2018. A Guide to Project Finance

11 McKinsey, 2019. Getting Infrastructure Projects Right: A Legal Adviser’s View on Standardization.

12 Moody’s, 2018. Bayfront Infrastructure Capital Pte Ltd New Issue – A Project Finance and Infrastructure Loan-Baked Transaction.

13 Clifford Capital, 2018. Inaugural Infrastructure Project Finance Securitisation in Asia.

This article is collated by Infrastructure Asia.

Special thanks to Nicholas Wong (Clifford Chance) and Kok Chee Wai (Allen & Gledhill) for their comments